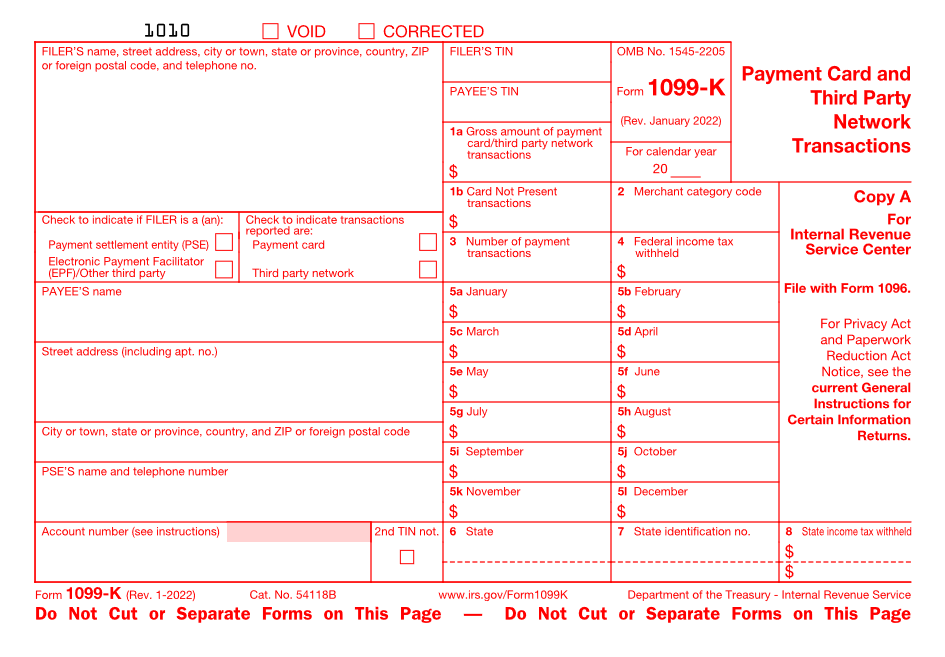

Emerging Compliance Issues Subgroup Report A. IRC § 6050W and Form 1099-K, Payment Card and Third Party Network Transactions, R

Sec. 6050W. Returns Relating To Payments Made In Settlement Of Payment Card And Third Party Network Transactions